While the idea of a “$0 down” bankruptcy may seem appealing, there are several potential drawbacks to be aware of.

Tag: utah bankruptcy lawyer

3 Ways to Fight a Garnishment: Utah Bankruptcy

It is important to take action as soon as possible if you are facing a wage garnishment. Ignoring the issue will only make it worse, and you may end up losing more of your wages over time.

15 Ways to Bounce Back After Bankruptcy

Bankruptcy can be a difficult and stressful situation to go through, but there are steps you can take to come out of it for the better. The team at the Utah Bankruptcy Guy works with people just like you everyday. Over the years we have come up with the common things people do to make life after bankruptcy easier. Here are 15 ways to help you get back on your feet after bankruptcy.

Involuntary Bankruptcy: Utah Bankruptcy

Involuntary bankruptcies are relatively rare in Utah and are typically only used in situations where creditors believe that the debtor is purposely avoiding their obligations or engaging in fraudulent behavior.

What Do I Tell My Lawyer: Utah Bankruptcy

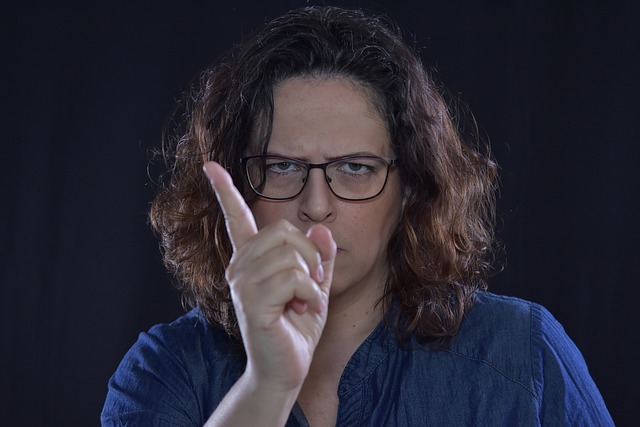

It is not a good idea to hide information from your bankruptcy lawyer. When you hire a Utah bankruptcy lawyer, they are legally bound to maintain client confidentiality, which means that they cannot share your information with anyone without your permission.

How often can you file a Utah bankruptcy?

The frequency with which you can file for bankruptcy in Utah depends on the type of bankruptcy you want to file and the timing of your prior bankruptcy filings.

Five ways to get a home after a Utah bankruptcy.

Filing bankruptcy is a big decision. What you do after you file bankruptcy is very important. Getting into a home is a life long goal for many people. You sometimes need a little bit of help to know whot to do after a bankruptcy to achive your finacial goals. Thats what we try and help clients achieve. Thats why I wrote the book LIFE AFTER BANKRUPTCY: The Game Plan to Rebuild, Restore and Renew Your Credit After Bankruptcy!

Is Utah bankruptcy honest?

The Utah bankruptcy process is considered honest because it allows debtors to face their financial problems head-on, while also providing a way for creditors to be repaid to the extent possible.

What is Chapter 9 Bankruptcy?

It is worth noting that Chapter 9 bankruptcies are relatively rare compared to other types of bankruptcies, and that most municipalities prefer to avoid bankruptcy if at all possible.

Reverse Mortgage: Utah Bankruptcy

If a homeowner with a reverse mortgage is facing financial difficulties and is considering bankruptcy, there are several factors to consider.