$0 Down Bankruptcy – Think Twice Utah

“$0 down” Bankruptcy in Utah refers to a type of bankruptcy filing where an individual or business is able to file for bankruptcy without having to make any upfront payments or initial deposit. This type of Utah bankruptcy is often marketed as a way for those struggling with debt to file for bankruptcy without having to come up with a large amount of money upfront.

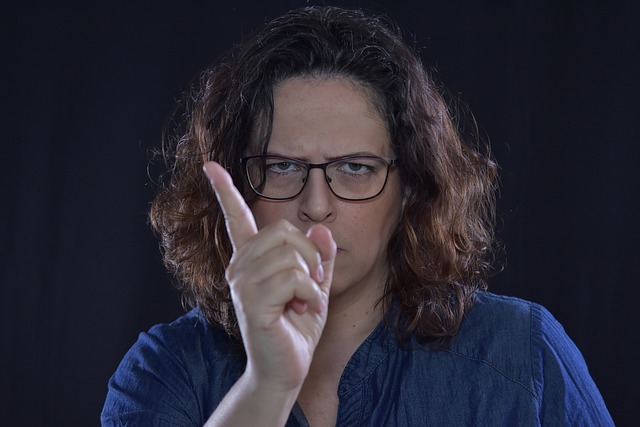

While the idea of a “$0 down” bankruptcy may seem appealing, there are several potential drawbacks to be aware of.

- Higher Costs: Although there is no upfront payment required, the overall cost of the Utah bankruptcy filing can still be high. This is because the lawyer or bankruptcy attorney handling the case may charge higher fees to cover the cost of the bankruptcy process. FYI there are low-cost bankruptcy option out there – Click Here to see real low-cost options.

- Hidden Costs: The “$0 down” offer may not cover all the costs associated with the bankruptcy process. For example, court fees and other expenses may not be included in the initial offer, and individuals may be responsible for paying these costs later.

- Lack of Representation: In some cases, the “0 down” bankruptcy offer may not include representation by a lawyer throughout the whole process. This is what they try and sell you as “Bifurcation” and it’s a bad deal. This skeem can result in an individual not having the necessary legal support and guidance during the bankruptcy process.

- Lack of Personalized Attention: By opting for a “$0 down” Utah bankruptcy offer, individuals may not receive the personalized attention and guidance they need to successfully navigate the bankruptcy process. This can result in a less favorable outcome and more difficulty in securing a fresh start after bankruptcy. Some have even started calling this “Zero Down Zero Help”.

While a “$0 down” bankruptcy may seem like a convenient option for those struggling with debt, it is important to carefully consider the potential drawbacks and hidden costs associated with this type of bankruptcy filing. Before making a decision, individuals should seek the advice of an experienced Utah bankruptcy lawyer to determine if this option is right for them.