It is important to take action as soon as possible if you are facing a wage garnishment. Ignoring the issue will only make it worse, and you may end up losing more of your wages over time.

Tag: taxes and bankruptcy

Utah Bankruptcy & Tax Refunds

Some come to see their income tax refunds as a type of yearly bonus. In reality these refunds are usually caused by having paid too much in taxes during the past year

Should I file bankruptcy

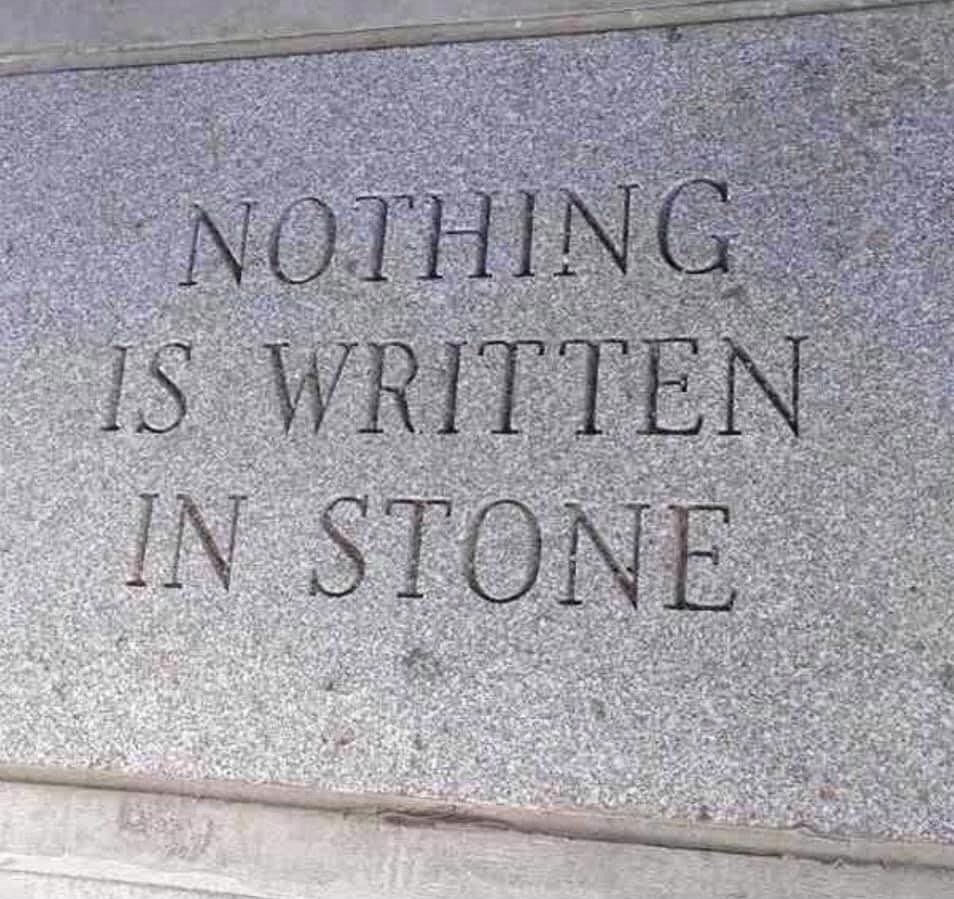

When I talk with a potential client I tell people the facts and point them in the direction that would be best for them financially based on their needs, wants and goals. Just because you talk with me does not mean that you need to file bankruptcy – nothing is written in stone.

Bankruptcy and Taxes

To better understand bankruptcy and taxes a little background information is needed; it then becomes more clear why bankruptcy and taxes are so enter twined. First you have to understand that bankruptcy is made possible because of federal laws, and the federal government is made possible because of tax dollars. Why would the government try to give you a perk when you really need the help?

Bankruptcy without tax returns

You can file a bankruptcy without tax returns but if you have unfiled tax returns it may be in your best interest to file them before you file as opposed to right after you file for bankruptcy. It is in you best interest to have your tax returns filed prior to the filing of your… Continue reading Bankruptcy without tax returns

What bankruptcy cannot do for you

Bankruptcy is not the silver bullet that will cure all your financial issues. Many people want to know what bankruptcy can do for them here is what bankruptcy cannot do for you. There are debts that bankruptcy cannot eliminate like student loans, child support, alimony and most secured debts. What bankruptcy cannot do for you and… Continue reading What bankruptcy cannot do for you

Tax refunds and bankruptcy

Some people come to see their income tax refunds as a yearly bonus. In reality these refunds are usually caused by a taxpayer having paid too much in taxes during the past year. Sometimes people have even come to rely upon these refunds for planned yearly spending to catch up on bills, go on vacation,… Continue reading Tax refunds and bankruptcy