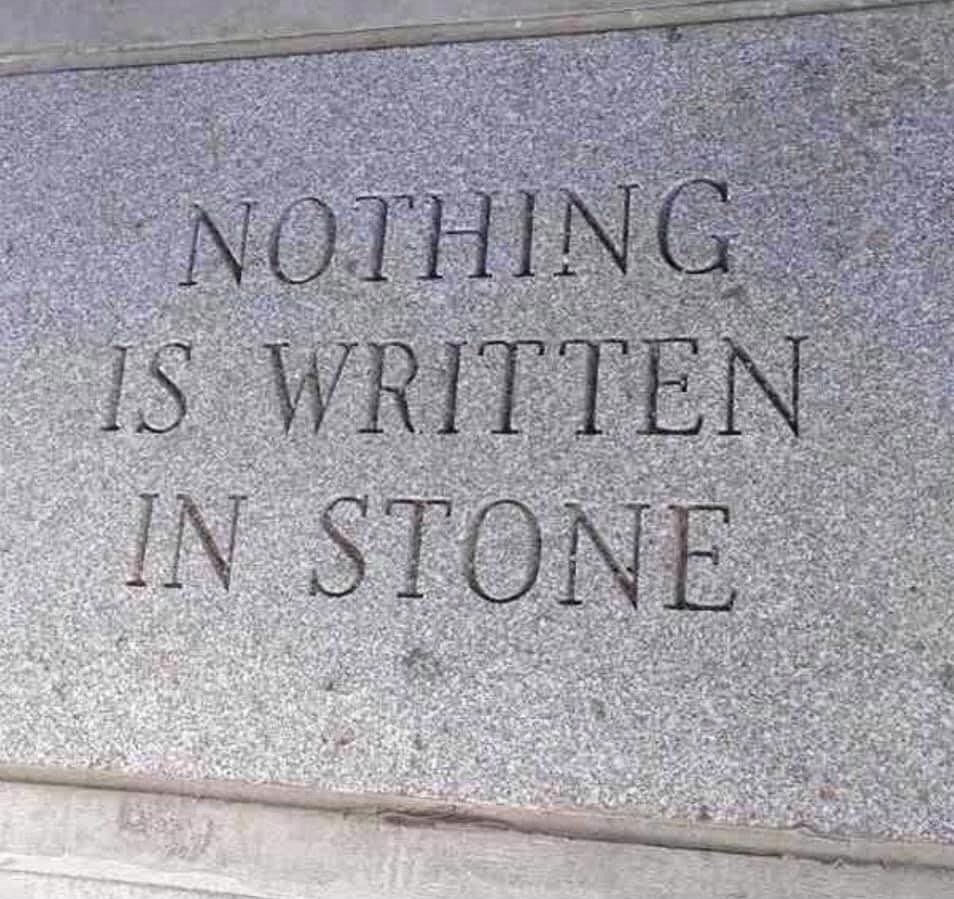

I’m an honest guy. When I talk with a potential client I tell people the facts and point them in the direction that would be best for them financially based on their needs, wants and goals. Just because you talk with me does not mean that you need to file bankruptcy – nothing is written in stone. In fact 20% of the people I talk to I actually advise them NOT to file bankruptcy. I’m not afraid to turn people away from bankruptcy if it is not within their best interest. For the people out there asking should I file bankruptcy? I think you should consider filing if you are in a situation where you could really use the following:

- A fresh start with little to no debt remaining

- A stop judgements, phone calls and/or wage garnishments

- Reestablish Credit

- A legal and honest way to keep your home or vehicle

In 2017 research was done that showed that 20 million Americans would have greatly benefited from bankruptcy had they filed https://www.ozy.com/acumen/why-20-million-americans-should-file-for-bankruptcy/90717/ for many people that research is just one of signs you should file bankruptcy. Bankruptcy is one of the most underutilized financial safety nets in our country.

Listed below are 15 warning signs that you should consider filing bankruptcy — one of these might just be the signs you should file:

- You are more than a month behind on your mortgage

- You are more than a month behind on your rent

- You’ve been taking pay-day loans, cash advances, title loans

- You’re unable to catch up on vehicle payments

- Unable to meet your basic monthly expenses for food, housing, or transportation without using credit cards

- Only able to make minimum payments or less on your debt

- Losing sleep or are suffering from anxiety due to worry and stress over money

- If you have received a notice that your car is going to be repossessed

- If you have received a notice that your home is going to be foreclosed

- Significant loss of income, or significant increase in bills — often times high medical bills, or legal fees

- Unable to pay off tax debt within 12 to 24 months

- Your or your partner’s wages are being garnished

- You’re being pursued by Creditors

- Thinking about a consolidation loan

- You don’t open your mail

- You have no savings or retirement

- You’ve been sued

- You’re unemployed

- Social Security Checks aren’t quite making the cut

- Can’t Recover from a major personal setback

- Your Credit Cards are Maxed Out

Want to talk? Call or text us today. In consumer bankruptcy cases we offer FREE consultations. If bankruptcy is not your best option we will point you in another direction.