Filing for bankruptcy during a divorce can have both positive and negative effects on your divorce case

Category: Utah Chapter 7

Bankruptcy and my Social Security

Social Security benefits are considered exempt property under federal law and are protected from creditors in bankruptcy.

10 things everyone looking into bankruptcy should know!

While bankruptcy can be a challenging process, it can also offer a fresh start for individuals or businesses struggling with debt.

$0 Down Bankruptcy – Think Twice Utah.

While the idea of a “$0 down” bankruptcy may seem appealing, there are several potential drawbacks to be aware of.

Involuntary Bankruptcy: Utah Bankruptcy

Involuntary bankruptcies are relatively rare in Utah and are typically only used in situations where creditors believe that the debtor is purposely avoiding their obligations or engaging in fraudulent behavior.

Reverse Mortgage: Utah Bankruptcy

If a homeowner with a reverse mortgage is facing financial difficulties and is considering bankruptcy, there are several factors to consider.

EIDL Loan: Utah Bankruptcy

The treatment of the EIDL loan in a Utah bankruptcy will depend on several factors, including the type of bankruptcy you file (Chapter 7 or Chapter 13), the amount of the loan, and the terms of the loan.

Discharge: Utah Bankruptcy

It’s important to note that the Utah bankruptcy discharge is not automatic and there are specific requirements that must be met in order to obtain it.

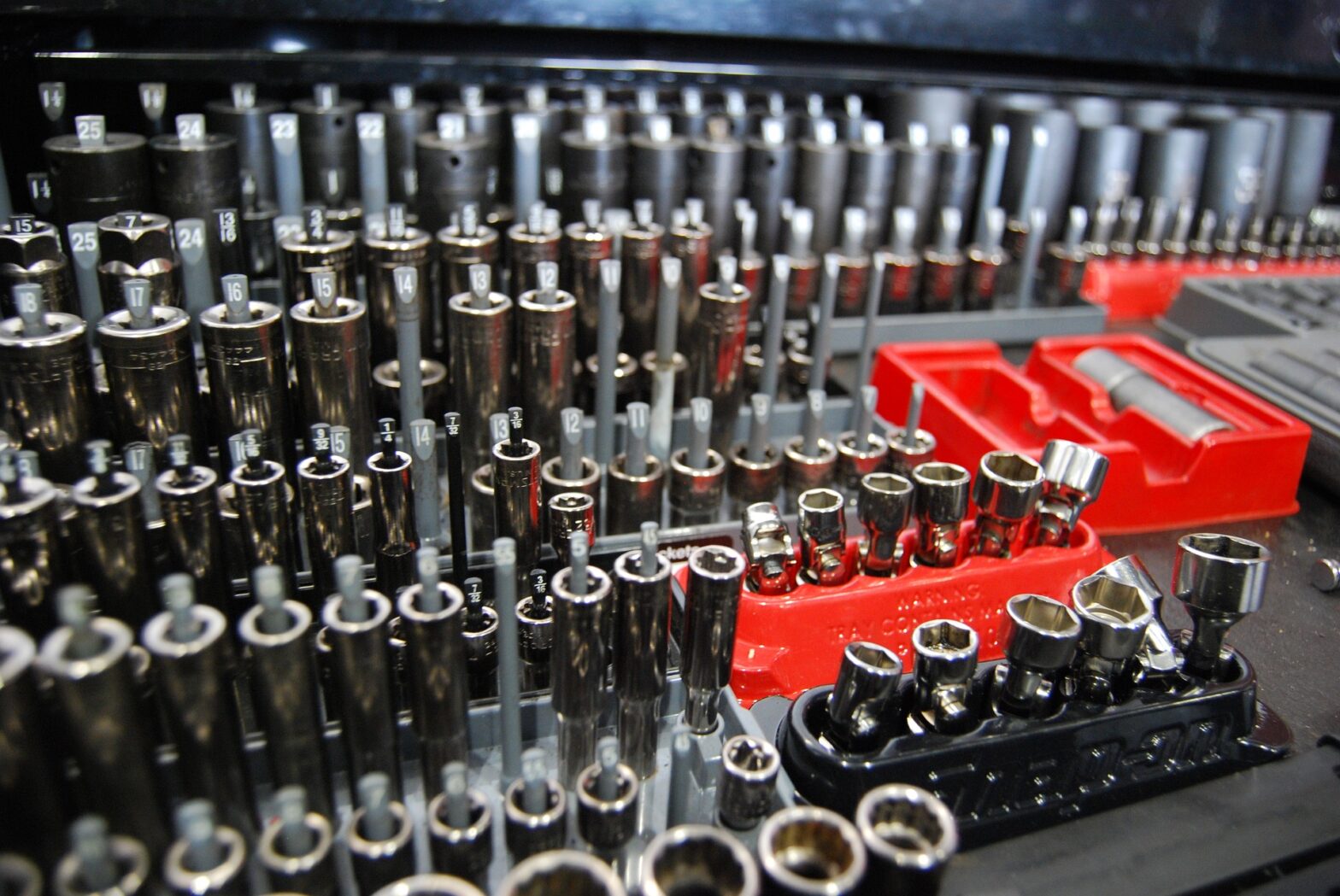

Work Tools: Utah Bankruptcy

Whether you will lose your work tools if you file for bankruptcy in Utah depends on the type of bankruptcy you file and the value of your tools.

How can Utah bankruptcy help me?

In Utah a bankruptcy can help you in several ways, but it’s important to note that it’s not a one-size-fits-all solution, and it should be carefully considered before making a decision.