Whether a mobile home can be saved in a Utah bankruptcy depends on several factors, including the type of bankruptcy you file, the value of the mobile home, and the amount of any outstanding liens on the mobile home.

Tag: exemption

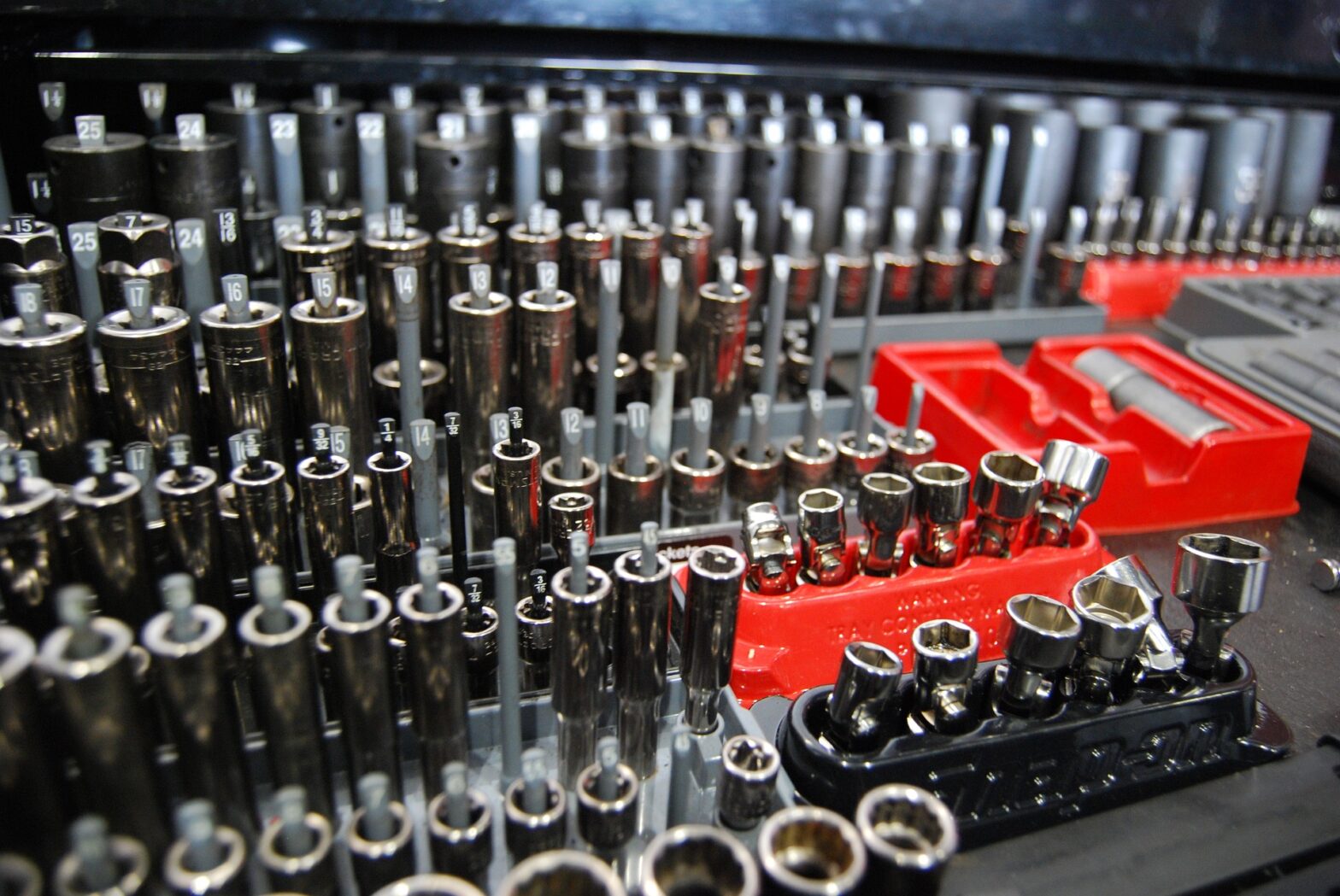

Work Tools: Utah Bankruptcy

Whether you will lose your work tools if you file for bankruptcy in Utah depends on the type of bankruptcy you file and the value of your tools.

Bankruptcy dollar adjustments

The bankruptcy dollar adjustments are required to take place every three years pursuant to 11 U.S.C. §104. The new dollar amounts reflect an approximate, average 11% increase.

Utah Bankruptcy Property Exemptions

The U.S Bankruptcy Code provides numerous exemptions that allow people filing bankruptcy to shield and keep the property they own. But some states do not use the federal law to protect property in bankruptcy they use the law of the state where the case if filed. These laws are called exemption laws.

Utah Bankruptcy Secrets

Utah bankruptcy secrets should be known to everyone. We want to help you make smart financial decisions. Here are 5 bankruptcy secrets everyone thinking about filing for bankruptcy in Utah should know.

Can I file bankruptcy and keep a car?

One of the foremost questions in the minds of many people think about bankruptcy is Can I file bankruptcy and keep my car? For the majority of individuals owning a car is an absolute necessity. Unless you live in a large city how else would you be able to get to work or the grocery… Continue reading Can I file bankruptcy and keep a car?

Bankruptcy without assets

There is no requirement to have assets when you file bankruptcy so you can certainly file bankruptcy without assets. In a “No Asset” Chapter 7 bankruptcy case, the debtor doesn’t own any assets or property that the creditors can take therefore they have a bankruptcy without assets. The debtor possesses nothing that can be sold… Continue reading Bankruptcy without assets