Chapter 15 is an important tool for handling complex cross-border insolvency cases, and it has been used in a number of significant cases over the years.

Category: Utah Bankruptcy Guy

Signs your Small Business is About to Go Bankrupt

Wondering if your Utah small business can survive in this uncertain time – Here are 7 signs to consider if you are wondering your next step:

Will I lose my dog? Utah Bankruptcy

Under bankruptcy law, certain types of property are considered exempt, meaning that they are protected from being sold or liquidated to pay off creditors.

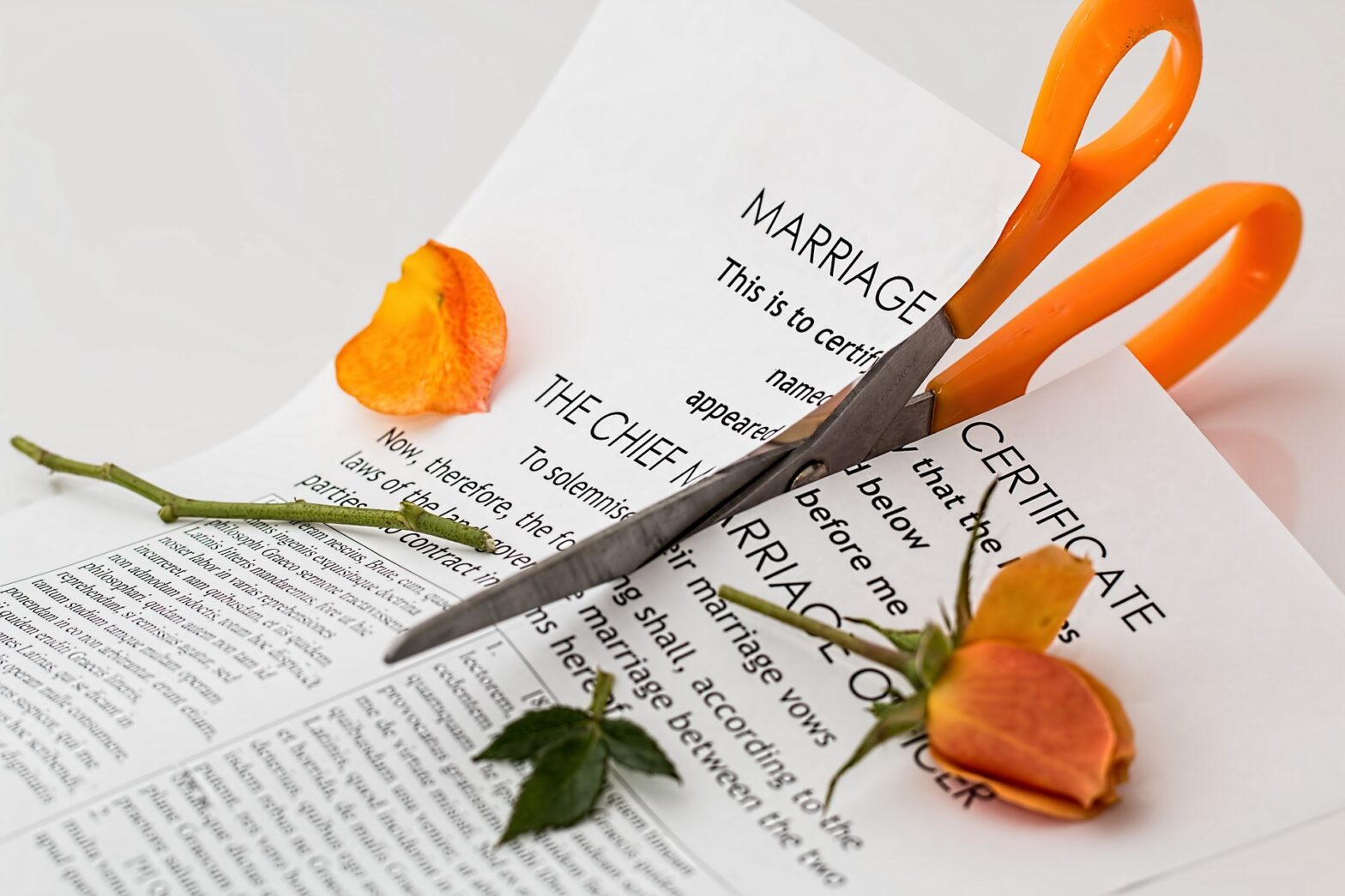

Can a Bankruptcy Affect my Divorce?

Filing for bankruptcy during a divorce can have both positive and negative effects on your divorce case

Bankruptcy and my Social Security

Social Security benefits are considered exempt property under federal law and are protected from creditors in bankruptcy.

10 things everyone looking into bankruptcy should know!

While bankruptcy can be a challenging process, it can also offer a fresh start for individuals or businesses struggling with debt.

$0 Down Bankruptcy – Think Twice Utah.

While the idea of a “$0 down” bankruptcy may seem appealing, there are several potential drawbacks to be aware of.

3 Ways to Fight a Garnishment: Utah Bankruptcy

It is important to take action as soon as possible if you are facing a wage garnishment. Ignoring the issue will only make it worse, and you may end up losing more of your wages over time.

15 Ways to Bounce Back After Bankruptcy

Bankruptcy can be a difficult and stressful situation to go through, but there are steps you can take to come out of it for the better. The team at the Utah Bankruptcy Guy works with people just like you everyday. Over the years we have come up with the common things people do to make life after bankruptcy easier. Here are 15 ways to help you get back on your feet after bankruptcy.

Involuntary Bankruptcy: Utah Bankruptcy

Involuntary bankruptcies are relatively rare in Utah and are typically only used in situations where creditors believe that the debtor is purposely avoiding their obligations or engaging in fraudulent behavior.