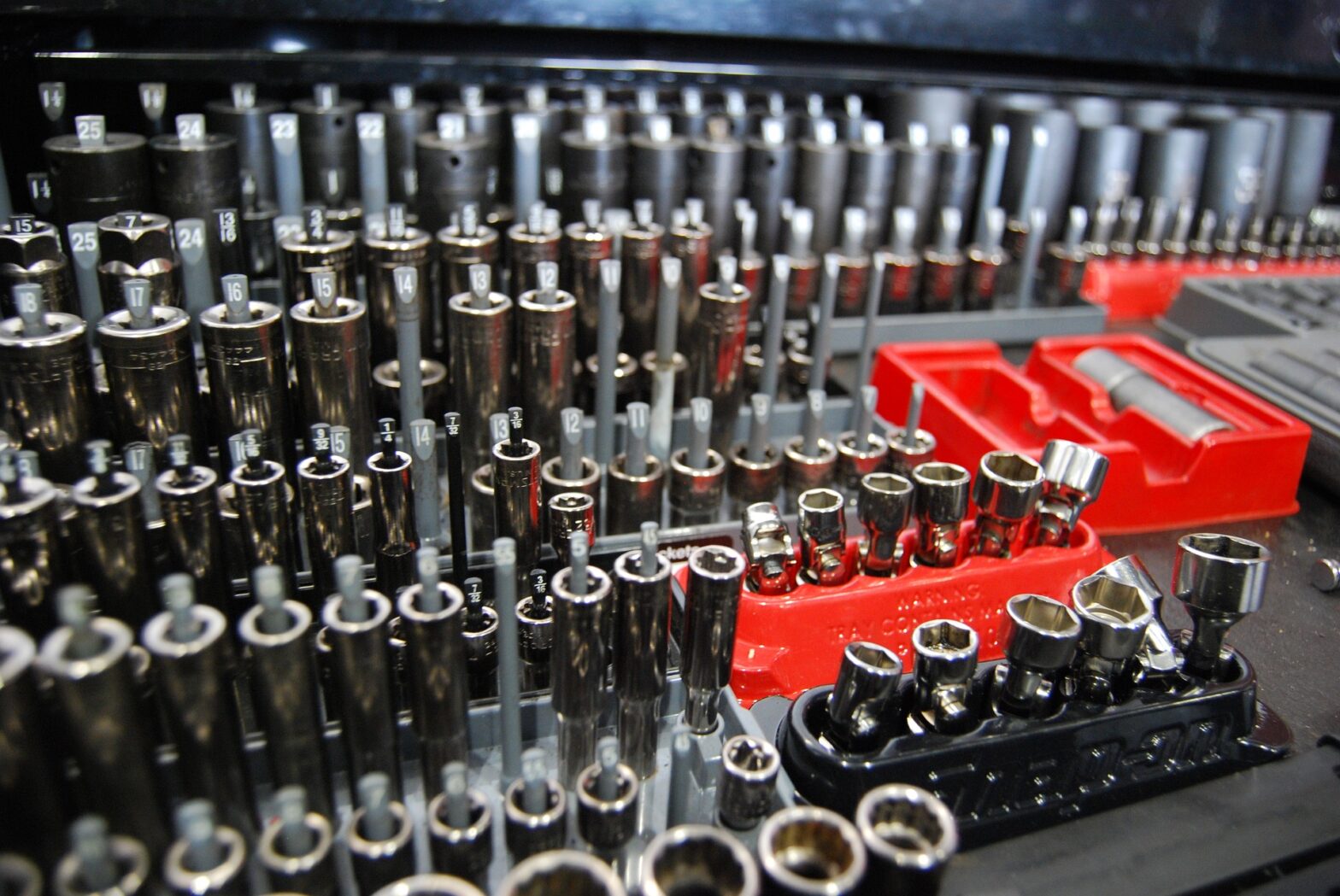

Whether you will lose your work tools if you file for bankruptcy in Utah depends on the type of bankruptcy you file and the value of your tools.

In a Utah Chapter 7 bankruptcy, your non-exempt assets can be sold to pay your creditors. However, most states have exemptions that protect certain types of property, such as work tools, from being sold in a bankruptcy. The exemption amount varies by state, so it’s important to consult with a bankruptcy attorney in your state to determine whether your work tools would be exempt. As of 2023 the Utah Tools of the Trade exemption was $5,000.00. This amount changes periodically.

If your work tools are not exempt, you may be able to negotiate with the bankruptcy trustee to keep them by offering to pay the trustee the value of the tools or by providing some other arrangement that is agreeable to the trustee. Your bankruptcy attorney can be a big help in negotiating the best deal for you in this situation.

In a Utah Chapter 13 bankruptcy, you can keep your non-exempt assets, including work tools, as long as you make payments under your repayment plan that are sufficient to provide your creditors with at least as much as they would have received if you had filed for Chapter 7 bankruptcy.

Again, the specific rules regarding work tools and other property can vary by state, so it’s important to consult with a bankruptcy attorney in your state to determine the best course of action based on your specific situation. In Utah contact us to see what happens to my work tools if I file bankruptcy.