A homestead exemption is a legal provision that allows homeowners to protect a certain amount of equity in their primary residence from being seized by creditors in the event of bankruptcy.

Tag: exemption planning

Mobile Home: Utah Bankruptcy

Whether a mobile home can be saved in a Utah bankruptcy depends on several factors, including the type of bankruptcy you file, the value of the mobile home, and the amount of any outstanding liens on the mobile home.

Will I lose my dog? Utah Bankruptcy

Under bankruptcy law, certain types of property are considered exempt, meaning that they are protected from being sold or liquidated to pay off creditors.

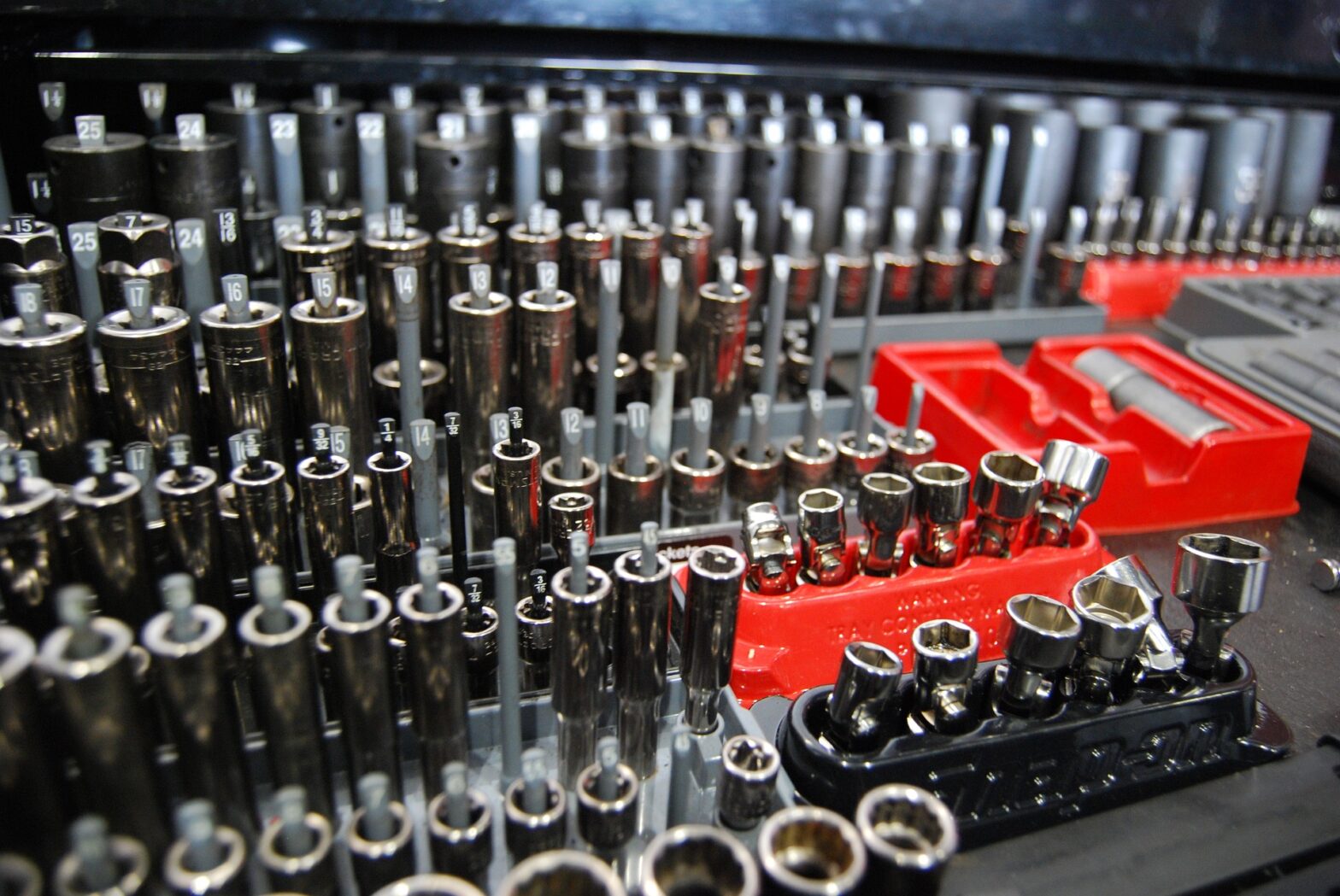

Work Tools: Utah Bankruptcy

Whether you will lose your work tools if you file for bankruptcy in Utah depends on the type of bankruptcy you file and the value of your tools.

Utah Bankruptcy Property Exemptions

The U.S Bankruptcy Code provides numerous exemptions that allow people filing bankruptcy to shield and keep the property they own. But some states do not use the federal law to protect property in bankruptcy they use the law of the state where the case if filed. These laws are called exemption laws.